Key Bank Personal Financial Statement free printable template

Show details

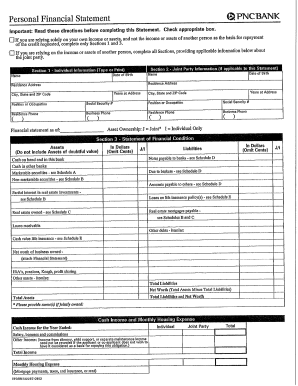

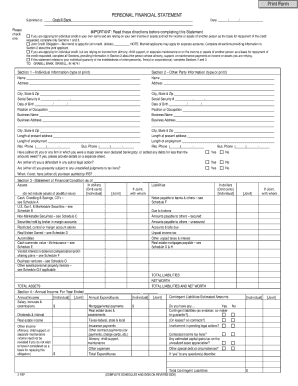

PERSONAL FINANCIAL STATEMENT CONFIDENTIAL IMPORTANT: DIRECTIONS TO APPLICANT To: Address: Personal Financial Statement as of (DATE) APPLICANT S NAME(S): HOME ADDRESS PHONE Assets Cash on hand and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign key bank statement template form

Edit your keybank bank statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your key bank statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit key bank personal financial statement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit keybank statement form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out key bank bank statement form

How to fill out Key Bank Personal Financial Statement

01

Obtain the Key Bank Personal Financial Statement form from the Key Bank website or a local branch.

02

Fill in your personal information at the top, including your name, address, and contact details.

03

Provide detailed information about your assets, including cash, investments, real estate, and other properties.

04

List all your liabilities, such as mortgages, loans, and credit card debts.

05

Calculate your net worth by subtracting total liabilities from total assets.

06

Include your income information, specifying sources of income, monthly amounts, and any additional income streams.

07

Detail your expenses, categorizing them into fixed and variable monthly expenses.

08

Review the document for accuracy and completeness before submission.

09

Sign and date the form to certify that the information provided is true and correct.

Who needs Key Bank Personal Financial Statement?

01

Individuals applying for loans or credit at Key Bank.

02

Small business owners seeking financing or business loans.

03

People looking to establish a detailed personal financial overview for personal budgeting or financial planning.

04

Anyone required to provide a financial statement for estate planning or legal purposes.

Fill

keybank statements

: Try Risk Free

People Also Ask about keybank check sample

What is a bank financial statement?

A bank's income statement contains two general categories: interest income and non-interest income. Interest income, as discussed prior, is the money earned from lending out customer deposits and the interest earned on the financing.

How do I get a financial statement from my bank?

Getting a copy of your bank statement is easy. Your online banking page will list out all of your statements. From there, you can download a PDF or order a paper version by mail. You can also call your bank's customer service line for help.

What are key financial statements?

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

What are the two key financial statements?

A set of financial statements includes two essential statements: The balance sheet and the income statement.

What are the five 5 basic financial statements?

Here's why these five financial documents are essential to your small business. The five key documents include your profit and loss statement, balance sheet, cash-flow statement, tax return, and aging reports.

Is a bank statement a financial statement?

Financial Statement/Official Bank Statement A financial statement is an official document issued by a bank which proves there are sufficient funds in a bank account to pay for a school's tuition expenses and all living costs while enrolled in their program.

Where can I find company financial statements?

Financial information can be found on the company's web page in Investor Relations where Securities and Exchange Commission (SEC) and other company reports are often kept. The SEC has financial filings electronically available beginning in 1993/1994 free on their website. See EDGAR: Company Filings.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my key bank statements directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your bank statement sample and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit bank statement template from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including statement key. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute template key bank bank statement template online?

pdfFiller has made filling out and eSigning bank statement pdf example easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is Key Bank Personal Financial Statement?

The Key Bank Personal Financial Statement is a document that provides a comprehensive overview of an individual's financial situation, including assets, liabilities, income, and expenses.

Who is required to file Key Bank Personal Financial Statement?

Individuals applying for loans, credit, or financial assistance from Key Bank may be required to file a Personal Financial Statement.

How to fill out Key Bank Personal Financial Statement?

To fill out the Key Bank Personal Financial Statement, gather all financial records, complete each section with accurate information, and ensure all assets and liabilities are reported.

What is the purpose of Key Bank Personal Financial Statement?

The purpose of the Key Bank Personal Financial Statement is to evaluate an individual's financial health and creditworthiness for lending purposes.

What information must be reported on Key Bank Personal Financial Statement?

The Key Bank Personal Financial Statement requires reporting of personal information, assets (such as cash, real estate, and investments), liabilities (like loans and debts), and details of income and expenses.

Fill out your Key Bank Personal Financial Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Key Statement is not the form you're looking for?Search for another form here.

Keywords relevant to bank statement example

Related to bank statement pdf sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.