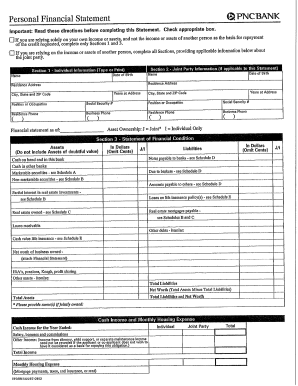

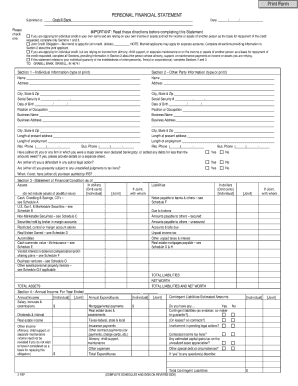

Get the free key bank personal statement

Get, Create, Make and Sign keybank bank statement form

How to edit key bank financial statement online

How to fill out key bank financial statement online form

How to fill out Key Bank Personal Financial Statement

Who needs Key Bank Personal Financial Statement?

Video instructions and help with filling out and completing key bank personal statement

Instructions and Help about key bank statement template

So let’s begin. We’re going to go into business together. We’re going to start a company, and we’re going to start a lemonade stand, and now I don’t have any money today, so I'm going to have to raise money from investors to launch the business. So how am I going to do that? Well I'm going to form a corporation. That is a little filing that you make with the State and you come up with a name for a business. We’ll call it Bill’s Lemonade Stand, and we’re going to raise money from outside investors. We need a little money to get started, so we’re going to start our business with 1,000 shares of stock. We just made up that number, and we’re going to sell 500 shares more for a $1 each to an investor. The investor is going to put up $500. We’re going to put up the name and the idea. We’re going to have 1,000 shares. He is going to have 500 shares. He is going to own a third of the business for his $500. So what is our business worth at the start? Well it’s worth $1,500. We have $500 in the bank plus $1,000 because I came up with the idea for the company. Now I'm going to need a little more than $500, so what am I going to do? I'm going to borrow some money. I'm going to borrow from a friend, and he’s going to lend me $250, and we’re going to pay him 10% interest a year for that loan. Now why do we borrow money instead of just selling more stock? Well by borrowing money we keep more of the stock for ourselves, so if the business is successful we’re going to end up with a bigger percentage of the profits. So now we’re going to take a look at what the business looks like on a piece of paper. We’re going to look at something called a balance sheet and a balance sheet tells you where the company stands, what your assets are, what your liabilities are and what your net worth or shareholder equity is. If you take your assets, in this case we’ve raised $500. We also have what is called goodwill because we’ve said the business—in exchange for the $500 the person who put up the money only got a third of the business. The other two-thirds is owned by us for starting the company. That is $1,000 of goodwill for the business. We borrowed $250. We’re going to owe $250. That is a liability. So we have $500 in cash from selling stock, $250 from raising debt, and we owe a $250 loan, and we have a corporation that has, and you’ll see on the chart, shareholders’ equity of $1,500, so that’s our starting point. Now let’s keep moving. What do we need to do to start our company? We need a lemonade stand. That’s going to cost us about $300. That is called a fixed asset. Unlike lemon or sugar or water this is something like a building that you buy, and you build it. It wears out over time, but it’s a fixed asset. And then you need some inventory. What do you need to make lemonade? You need sugar. You need water. You need lemons. Furthermore, you need cups. Furthermore, you need little containers and perhaps some napkins, and you need...

People Also Ask about keybank statement pdf

What is a bank financial statement?

How do I get a financial statement from my bank?

What are key financial statements?

What are the two key financial statements?

What are the five 5 basic financial statements?

Is a bank statement a financial statement?

Where can I find company financial statements?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my key bank pfs directly from Gmail?

How can I edit key bank bank statement from Google Drive?

How do I execute schedule bank applicant online?

What is Key Bank Personal Financial Statement?

Who is required to file Key Bank Personal Financial Statement?

How to fill out Key Bank Personal Financial Statement?

What is the purpose of Key Bank Personal Financial Statement?

What information must be reported on Key Bank Personal Financial Statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.